Competition = Lower Costs

The insurance industry includes thousands of different companies hoping to earn your business. It is a very competitive market and it pays to shop around for the very best deals. This is where I come in.

Whether you're searching for Life Insurance, Retirement strategies, or Health Insurance, you must be well-informed and well-advised to get the most out of your premium dollars. Having an experienced and independent agent who represents multiple insurance carriers can make a huge difference in what you pay for coverage.

Retirement Planning and Debt Elimination

As a retirement planner my whole goal is to protect your assets. Using life insurance and protected investment strategies I will build a wall around your estate and assets to protect them. In addition I have different strategies to show people how to become debt free without ruining your credit, including paying off a 30 year mortgage in 1/3 of the time. One strategy might be using a specially designed insurance contracts to help payoff your debts while also protecting you against financial or medical catastrophes that may arise.

Individual and Group Health Insurance

Nearly everybody is confused about their healthcare options - and rightly so. You can't rely on politicians or media reports for a clear and unbiased explanation. You want the facts, not opinions. I'd be happy to evaluate your current coverage and present you with side-by side comparisons of alternatives. I have alternatives that can save you on average 20% to 40% off your monthly premiums with no co-pays and no out of pocket deductables while having access to the largest PPO network for doctors and specialists.

Long-Term Care, Life Insurance and Final Expense Insurance

Long-Term Care Insurance gives you the financial means and the support options you desire. Whether you require in-home visits, assisted living or skilled nursing care, Long-Term Care Insurance lifts the burden from those around you, improving the quality of life for yourself and for everyone you hold dear.

Your family will always come first. You wouldn't want them to bear huge and unexpected financial burdens if you are unable to provide for them because you suffered an unexpected illness such as cancer, a heart attack, a stroke or at the time of your passing. No matter what your age, it's absolutely essential to have a plan in place to protect your loved ones when you are no longer able too. I specialize in life insurance with Living Benefits where you can access up to 90% of the insurance benefit to address critical and chronic health care needs when they occur. In addition, Final Expense insurance will pay for your funeral service, bills and other associated costs.

Why Should I Call for Insurance?

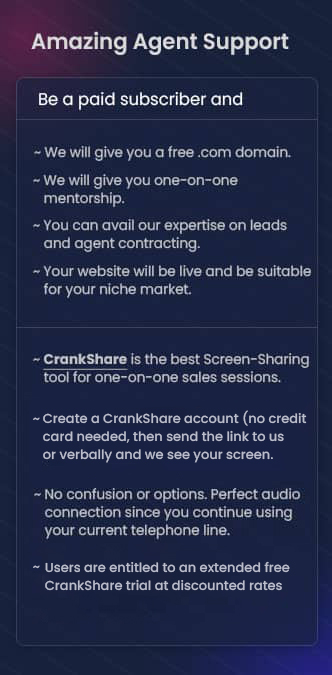

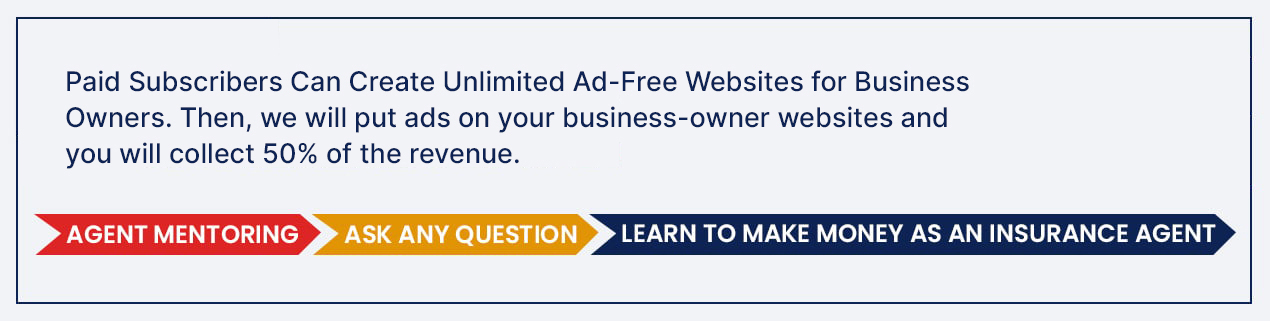

Good question. There are a lot of insurance agents out there and it may seem like any agent or broker is as good as another. But my team and I are decidedly different.

Let's face it, insurance jargon can be very confusing. My team and I know the ins and outs of the insurance business, and our inside knowledge of the many companies, products and strategies depending on your needs will work to your advantage. In fact, different insurance companies often charge vastly different premiums for the exact same coverage. As an independent agent I am not employed by one particular company. Instead, I can select insurance products from among those companies that best address your unique concerns.

I promise to focus my attention on your benefit exclusively.

Please don't hesitate to call me with your questions no matter whether you are already a valued customer, a potential client or if you simply need expert advice. There will never be a charge for my assistance or for a friendly, no-obligation chat.